Business Insurance in and around Neosho

Calling all small business owners of Neosho!

This small business insurance is not risky

This Coverage Is Worth It.

Running a business is about more than making a profit. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for the ones you care for. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with business continuity plans, errors and omissions liability and a surety or fidelity bond.

Calling all small business owners of Neosho!

This small business insurance is not risky

Cover Your Business Assets

Whether you own a beauty salon, a veterinarian or a pizza parlor, State Farm is here to help. Aside from excellent service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

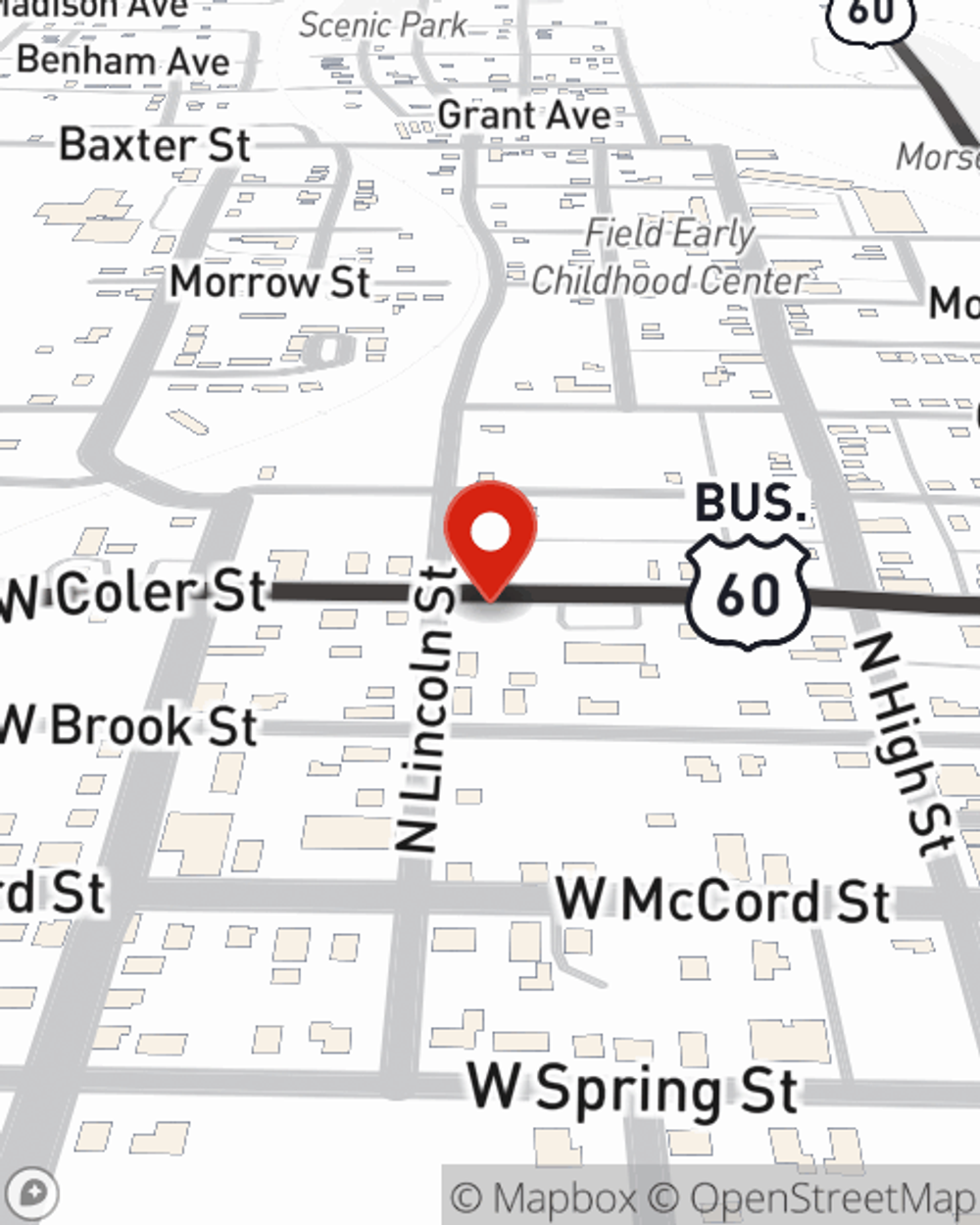

Get right down to business by calling or emailing agent Eric Norris's team to discuss your options.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Eric Norris

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.